The economic growth outlook is improving in Germany — and in Europe as a whole — amid a fiscal plan that emerged after Germany’s federal election and the prospect of higher military spending across the region, according to Goldman Sachs Research.

German voters in late February put Friedrich Merz in line to become Chancellor and gave his Christian Democratic Union (CDU) and the Social Democratic Party (SPD) a slim legislative majority that should allow for a two-party coalition. This outcome makes higher government spending more likely. The coalition partners have announced a fiscal plan to exempt substantial defense outlays from Germany’s so-called debt brake and to create a €500 billion ($546 billion) off-budget infrastructure and climate protection fund, among other steps.

In light of these developments, Goldman Sachs Research Chief European Economist Sven Jari Stehn and his team increased their forecast for real GDP growth in Germany this year to 0.2% from flat. They also raised their 2026 forecast by 0.5 percentage point to 1.5% and increased the estimate for 2027 by 0.6 percentage point to 2%.

“Growth could be higher with quicker implementation,” Stehn and his colleagues write in a report. “In practice, we think the implementation will be more gradual given capacity constraints and well-known challenges with stepping up public investment.”

Why the German economy is improving

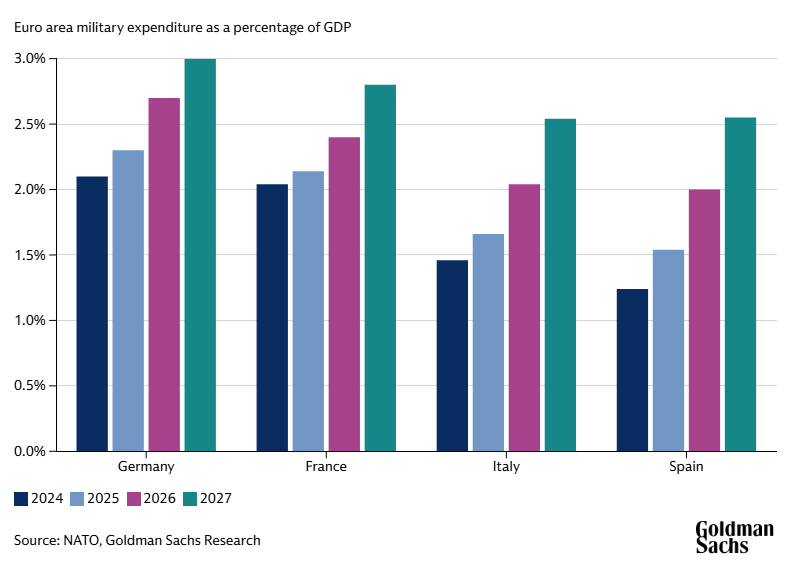

The researchers examine the potential impact of three key elements in the fiscal plan. Defense spending in excess of 1% of GDP would become exempt from the debt brake, Germany’s constitutional limit on structural deficits. The team sees military spending ramping up to 3% of GDP by 2027 and reaching 3.5% after that. The off-budget infrastructure and climate protection fund, designed to last 12 years, would boost spending gradually, raising expenditures by €40 billion above our economists’ pre-election baseline in 2027. A third feature of the fiscal plan increases the permissible structural deficit German states can run. This and the freed-up space in the federal budget may be partially used for tax cuts.

The lower house of parliament (Bundestag) passed the package this week and our researchers expect the fiscal package to also pass the upper house (Bundesrat) later this week, before newly elected Bundestag members are seated in late March. Business leaders and investors have been pushing for a loosening of Germany’s debt rules and a boost in government spending, as the economy has been sluggish for several years, a growth laggard among the large European nations.

The outlook for euro area GDP growth

The researchers also raised their forecasts for the euro zone as a whole. They added 0.1 percentage point to this year’s growth estimate, bringing it to 0.8% for the region. They increased the 2026 forecast by 0.2 percentage point to 1.3%, and boosted the 2027 numbers by 0.3 percentage point to 1.6%.

“One reason is that we expect stronger growth in Germany to spill over into neighboring countries,” Stehn writes of the forecast change. “Another reason is that we now expect the rest of the euro area to step up military spending somewhat more quickly in response to the German announcement.”

The team sees France boosting defense spending to 2.9% of GDP by 2027, Italy reaching 2.8% of GDP, and Spain boosting outlays to 2.7% of GDP. This is a 0.3 percentage point increase from the researchers’ previous estimates. Some of the increases in defense outlays could be offset by spending cuts elsewhere or tax increases, the researchers note, as these countries bump up against their own fiscal limits, resulting in a smaller economic boost.

“We see risks in both directions around our new forecast” for the euro zone, Stehn writes. A steeper increase in public spending, especially in Germany, could create faster-than-forecast growth in 2026 and 2027.

On the other hand, the researchers acknowledge the ongoing risk that tariffs and trade tensions with the US might have a greater-than-expected impact. The researchers have as a baseline a 0.5 percentage point drag on growth from targeted tariffs and trade policy uncertainty in 2025. “An across-the-board tariff could imply an additional hit to growth of 0.5% this year,” they write.

The prospect of increased government spending across the euro zone decreases pressure on the European Central Bank to cut rates below the neutral policy rate, the researchers find. They now expect that the central bankers will be satisfied by cutting rates to a terminal rate of 2%, with 0.25% cuts expected in April and June (the policy rate is 2.5% now), rather than lowering it further in July.